2025 Lifetime Gift Tax Exemption Amount - 2025 Lifetime Gift Tax Exemption Kaela Clarine, The 2025 gift tax limit (also known as the gift tax exclusion) increased to $18,000 this year from $17,000 last year. 2025 Lifetime Gift Tax Exclusion Amount Joby Rosana, In 2025, the lifetime gift tax exemption is $13.61 million per individual.

2025 Lifetime Gift Tax Exemption Kaela Clarine, The 2025 gift tax limit (also known as the gift tax exclusion) increased to $18,000 this year from $17,000 last year.

2025 Gift Tax Exemption Amount Aubry Candice, What is the gift tax annual exclusion amount for 2025?

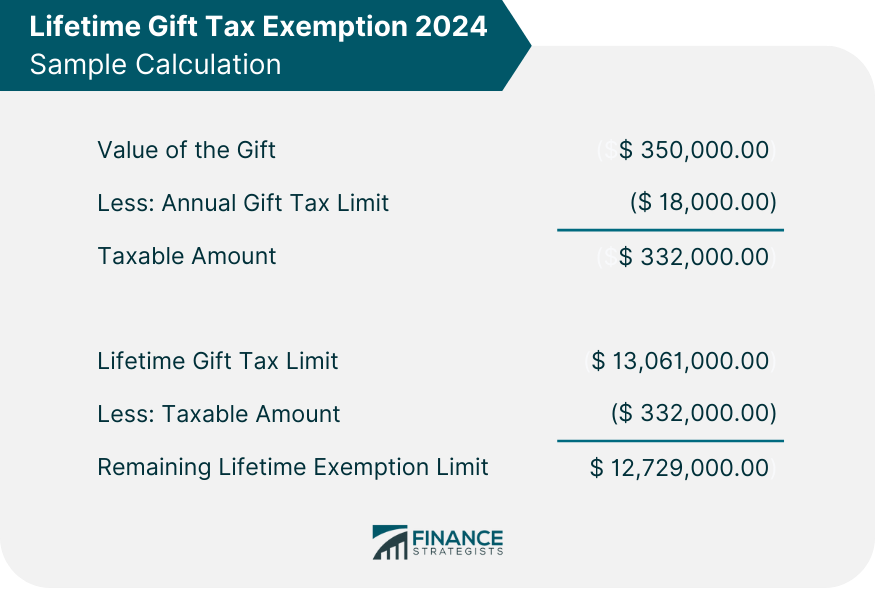

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, Here are the key numbers:

Lifetime Gift Tax Exemption 2022 & 2025 Definition & Calculation, In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from.

Annual Gift Tax Limit 2025 Aleda Aundrea, In 2025, the lifetime gift tax exemption is $13.61 million per individual.

2025 Gift Tax Exemption Amount Ros Leoine, There's no limit on the number of individual gifts that can be made, and couples can give.

2025 Lifetime Gift Tax Exemption Donica Kiersten, Lifetime irs gift tax exemption if a gift exceeds the $18,000 limit for 2025, that does not automatically trigger the gift tax.

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, As of 2025, the lifetime exemption is $13.61 million per individual.

2025 Lifetime Gift Tax Exemption Amount. In 2025, the gift and estate tax exemption is $13.61. For married couples, the limit is $18,000 each, for a total of $36,000.

Annual Gift Tax Exclusion 2025 Golda Gloriane, This credit, which applies to gifts made during lifetime or at death, is known as the gift and estate tax exemption.

(that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for. Starting january 1, 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person.