Mega Roth Contribution Limits 2025 - Roth IRA Limits for 2025 Personal Finance Club, Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're. SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, Contributor makes a contribution to a traditional ira for that. For the tax year 2025, the maximum contribution to a roth ira is $7,000 for those younger than 50 and $8,000 for those who are 50 or older.

Roth IRA Limits for 2025 Personal Finance Club, Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're.

Mega Roth Contribution Limits 2025. The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older. If you're 49 and under, you can contribute up to $7,000 to a roth ira in 2025.

Roth IRA Limits And Maximum Contribution For 2021, While the 2025 maximum ira contribution is $7,000 ($8,000 if you're over 50), not everyone can take full. 2025 roth 401(k) contribution limits the maximum amount you can contribute to a roth 401(k) for 2025 is $23,000 if you're younger than age 50.

"Your Guide to Roth IRA Contribution Limits 2025 in the USA" MyBikeScan, You can add $1,000 to those amounts if you're 50 or older. For 2025, this limitation is increased to $53,000, up from $50,000.

Roth IRA Contribution Limits 401(k) Plan Finance Strategists, For the 2025 tax year, the limit is $6,000, or $7,000 if you're age 50 or. Roth ira contribution limits (tax year 2025)

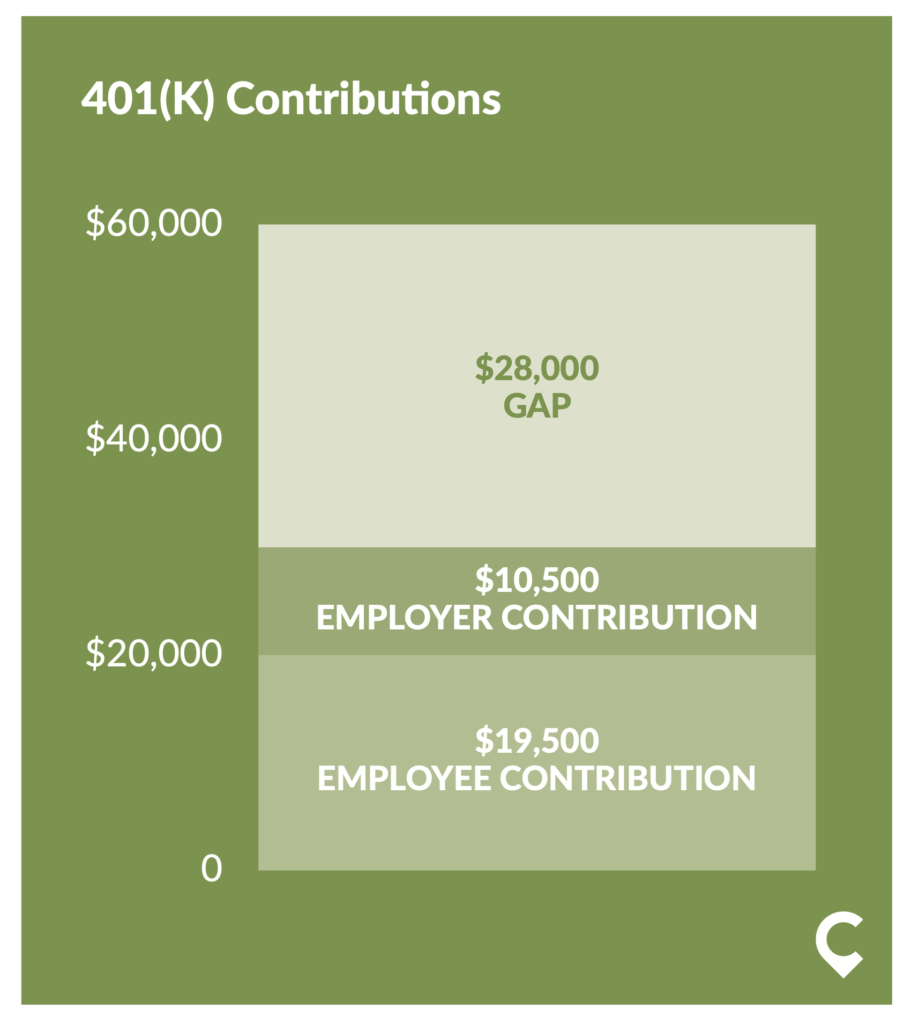

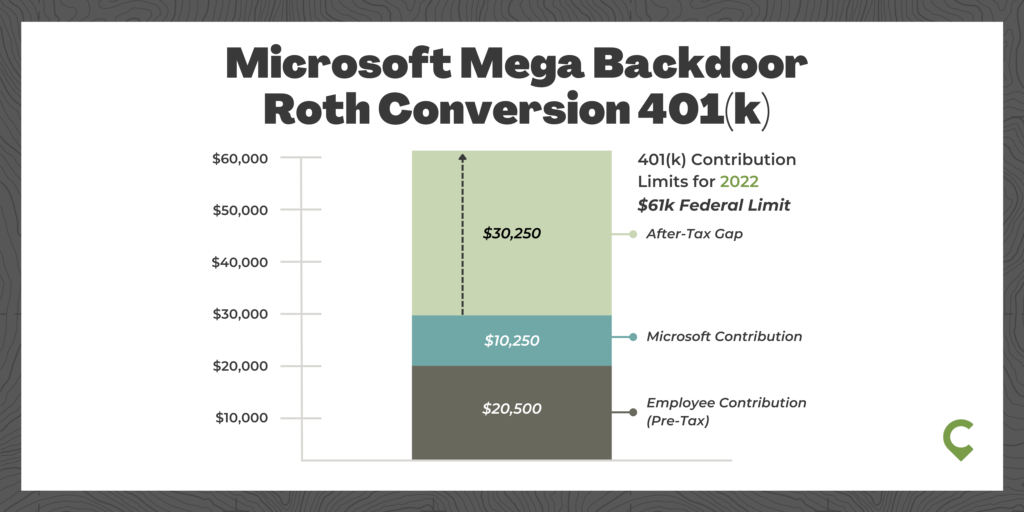

Microsoft 401k Mega Backdoor Roth Conversion How it Works, Can you max out a traditional or roth ira in 2025?. Contributor reaches an income level that is over the roth ira contribution income limit in a given year.

2025 roth ira income limits. But there are income limits that restrict who can contribute.

The IRS announced its Roth IRA limits for 2022 Personal, Employers can contribute to employee. Roth ira contribution limits (tax year 2025)

Story continues if you're eligible for this extra savings boost, be sure.

The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you’re.

Your Guide to the Mega Backdoor Roth Case Study + Free Flow Chart, In 2025, the contribution limit for a roth 401(k) is $23,000, plus an additional contribution of $7,500 if you are age 50 or older. Employers can contribute to employee.

The roth ira contribution limit is $6,500 per year for 2025 and $7,000 in 2025.

IRA Contribution Limits in 2025 Meld Financial, The roth ira contribution limits will increase in 2025 in november, the internal revenue service published updated ira contribution limits for 2025. Mega backdoor roths allow you to contribute more money to your roth ira than traditional contribution limits;

The roth ira income limits will increase in 2025 contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

2025 roth 401(k) contribution limits the maximum amount you can contribute to a roth 401(k) for 2025 is $23,000 if you’re younger than age 50.

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, But there are income limits that restrict who can contribute. The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're.

If you're 49 and under, you can contribute up to $7,000 to a roth ira in 2025.